Village

of Williamsville Code

Previous Chapter | Table of Contents | Next Chapter

Chapter 97: Taxation

§ 97-1. Imposition

of tax.

§ 97-2. Payment

of tax.

§ 97-3. Purpose.

§ 97-4. Statement

of maximum exemption.

§ 97-5. Proportional

increase or decrease in exemption.

§ 97-6. Property

affected.

§ 97.7. Manner

of making adjustment.

§ 97-8. Exemption

stated.

[HISTORY: Adopted by

the Board of Trustees of the Village of Williamsville: Art I, 6-11-74 as

L.L. No. 1-1974; Art. II, 2-11-85 as L.L. No. 2-1985; Art. III, 10-28-85

as L.L. No. 5-1985; Art. IV, 12-4-87 as L.L. No. 8-1987. Section 97-8 amended

at time of adoption of Code: see Ch. 1, General Provisions, Art. I. Other

amendments noted where applicable.]

ARTICLE I

Tax on Utilities

[Adopted 6-11-74 as L.L.

No. 1-1974]

§ 97-1. Imposition

of tax.

Pursuant to § 5-530

of the Village Law, there is hereby imposed upon the furnishing of utility

services in the Village of Williamsville the tax provided for in §

186-a of the Law. Such tax shall be at the rate of one per centum (1%)

of gross income or of gross operating income, as the case may be.

§ 97-2. Payment of

tax.

The tax imposed by this

Article shall be paid to the chief fiscal officer of the village at the

same time and in the same manner as returns and payments to the State Tax

Commission are required to be made.

ARTICLE II

Alternative Veterans Exemption

[Adopted 2-11-85 as L.L.

No. 2-1985]

§

97-3. Purpose

The purpose of this Article

is to grant the maximum veterans exemption allowable pursuant to §

458-a of the Real Property Tax of the State of New York.

§

97-4. Statement of maximum exemption.

Pursuant to the provisions

of Subdivision 2(d) of § 458-a of the Property Tax Law of the State

of New York, the maximum veteran exemption from real property taxes allowable

pursuant to § 458-a of the Real Property Tax Law is established as

follows:

A. Qualifying residential

real property shall be exempt from taxation to the extent of fifteen percent

(15%) of the value of such property; provided, however, that such exemption

shall not exceed the lesser of twelve thousand dollars ($12,000.) or the

product of twelve thousand dollars ($12,000) multiplied by the latest state

equalization rate for the Village of Williamsville.

B. In addition to the

exemption provided by Subsection A, when the veteran served in a combat

theater or combat zone operations as documented by the award of a United

States campaign ribbon or service medal, qualifying residential real property

also shall be exempt from taxation to the extent ten percent (10%) of the

value of such property provided, however, that such exemption shall not

exceed lesser of eight thousand dollars ($8,000.) or the product of eight

thousand dollars ($8,000.) multiplied by the latest state equalization

rate for the Village of Williamsville.

C. In addition to the

exemptions provided by Subsections A and B, where the veteran received

a compensation rating from United States Veterans' Administration because

of a service connected disability, qualifying residential real property

shall be exempt from taxation to the extent of the product of the assessed

value of such property multiplied by fifty percent (50%) of the veteran's

disability rating, provided, however, the such exemption shall not exceed

the lesser of forty thousand dollars ($40,000.) or the product of forty

thousand dollars ($40,000.) multiplied by the latest state equalization

rate of the Village of Williamsville.

ARTICLE III

Change in Assessment of Property

Subject to Veterans Exemption

[Adopted 10-28-85 as

L.L. No. 5-1985]

§ 97-5. Proportional

increase or decrease in exemption.

If the ratio between the

exemption for veterans granted under § 458 of the Real Property Tax

Law and the total value of the real property for which such exemption has

been granted inch or deck due only to a full-value assessment in the Village

of Williamsville, the amount of the exemption heretofore or hereafter granted

shall be increased or decreased in the same proportion as the total value

is inch or deck.

§ 97-6. Property

affected.

The exemption granted pursuant

to this Article shall be granted to real property for which an exemption

has been granted pursuant to § 458 of the Real Property Tax Law on

the assessment roll immediately preceding the change in level of assessment,

provided that property is owned by the veteran or by another person eligible

to receive such exemption.

§ 97-7. Manner of

making adjustment.

The adjustment provided

for in § 97-5 shall be made by the possessor in the manner provided

in Paragraph 3 of Subdivision 1 of § 458 of the Real Property Tax

Law. No application therefor need be filed by or on behalf of any owner

of any eligible property.

ARTICLE IV

Senior Citizen Exemption

[Adopted 12-14-87 as

L.L. No. 8-1987]

§ 97-8. Exemption

stated.

(1) Editor's Note: Amended

at time of adoption of Code; see Ch. 1, General Provisions, Art.

Effective December 15,

1987, an exemption from taxation of a variable percent of assessed valuation

is granted to those property owners sixty-five (65) years of age or over

who have owned their home more than two (2) years and whose annual income

meets the following criteria:

| Income Range |

Percentage of Exemption |

| $ 0 - $12,025 |

50 |

| $12,026 - $12,525 |

45 |

| $12,526 - $13,205 |

40 |

| $13,206 - $13,525 |

35 |

| $13,526 - $14,025 |

30 |

| $14,026 - $14,525 |

25 |

| $14,526 - $15,025 |

20 |

Previous Chapter | Table of Contents | Next Chapter

|

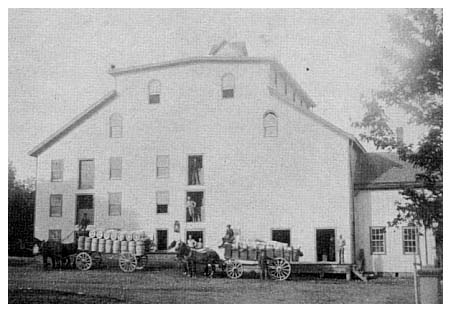

A picture of The Dodge Mill The front side of the Dodge Roller Mill taken from Mill St in Williamsville. click here to see a bigger picture.

|

|

A picture of The Dodge Mill This picture of the Dodge Mill before it burned was taken around 1880. click here to see a bigger picture.

|

Click Here to see more pictures

|

|